The Effective Interest Method: Why Not All Payments Are Created Equal

Interest payments drive modern society. From student loans to car payments to mortgages, it’s hard to not know anyone who isn’t paying interest in their daily life. But how much are you paying interest every month? The answer (most often) is that the amount changes every month based on the amount of money you owe. Loans tend to be structured in a way that the borrower is paying interest on the outstanding principal balance of the loan, with the remainder of the payment going towards that principal. This method of paying off interest is called the effective interest method in the accounting world.

What does it mean for me?

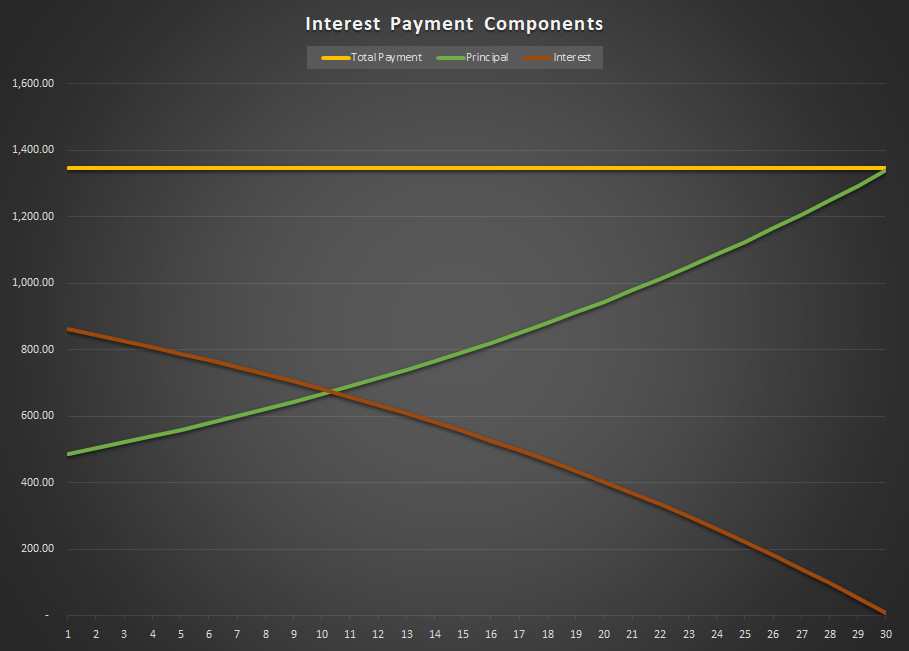

For most people, loan payments using the effective interest method means that they are paying significantly more in interest with their monthly payment in the beginning of the loan than they think. Just look at how the composition changes on the payments made on a 30-year mortgage:

With the amount of interest being based on the outstanding loan balance. The earlier payments have a significantly larger portion going towards interest, with only a small portion going towards the principal. The change is incredibly clear when you examine the difference between the first payment and the final (360th) payment, where the final payment consists almost entirely of principal balance being paid off. As the loan payments are made over time, a greater portion of the payment contributes to paying off the loan itself, rather than the interest. Another way to look at this phenomenon is to look at how interest and principal work as a component of your loan payment over time:

As you can see above, a 30-year mortgage payment plan has the borrower paying more in interest than principal during approximately the first 10 years of the 30-year term before the loan balance is lowered down to allow the principal portion to outweigh the interest. For those who are interested, the borrower will start paying more in principal than interest during the 124th monthly payment out of 360 total monthly payments.

Understanding how interest payments work is crucial to killing off the debt that the interest is building from. When in doubt, remember that the easiest way to pay less interest is to reduce the principal balance (by either taking out a smaller loan, or making extra payments that go 100% towards interest).